Beware of early renewal offers!

Why?

If your mortgage is coming up for renewal this year there is a good chance that your current mortgage lender will contact you months ahead of your actual renewal date and offer you the “opportunity” to renew your mortgage ahead of time.

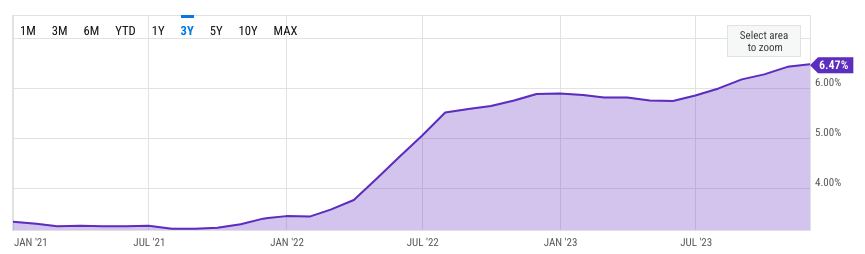

If this was fall 2021 or spring 2022 it might have been a good offer to take advantage of or for you to have us switch lenders early, as the market was moving from historically low rates towards increasingly high rates, so locking in a historically low rate made sense.

However, times have changed.

We are now at the tail end of a cycle of historically high rates, at least for the past twenty-plus years, and all indications that we should expect interest rates to start declining back to at least pre-pandemic levels. Lenders began to lower their fixed-term rates during the fall of 2023, following decreasing Bond rates, despite the Bank of Canada Prime lending rate remaining stable.

With the anticipation that the Bank of Canada will lower the Prime Rate between 50bps and 75 bps during 2023, further cuts should be inevitable. We anticipate that this trend will continue throughout 2024. So, unless you want to lock in historically high rates, now is NOT the time for an early renewal, and especially not into long-term rates.

So, in light of the aforementioned, do you think your bank wants you to “early renew” for your best interest or theirs?

In a decreasing rate environment, such as we are in now, it is best to wait as long as possible to renew, transfer or refinance your mortgage. Furthermore, by utilizing the services of your St. Thomas mortgage broker, you should also get a second opinion to ensure that you are given the best options to help you make an informed decision to ensure that you receive the best overall mortgage product for your needs.

In some instances, renewing with your current lender may be your best solution, albeit not an early renewal, however, you won’t know until you compare options with the guidance of our free service.

Prior to your mortgage renewal, you should also take the opportunity to think about your overall financial situation.

Do you have any debts that you would like to wrap into your mortgage?

Are there any home improvements that you would like to do?

Have you had any other changes that can affect your budget that you would like to take into consideration?

These are all things that you can talk with your St. Thomas mortgage broker about to ensure that you end up with the mortgage that best suits your needs.